Mortgage calculator with taxes by zip code

Then get pre-qualified to buy by a local lender. What type of mortgage is right for me.

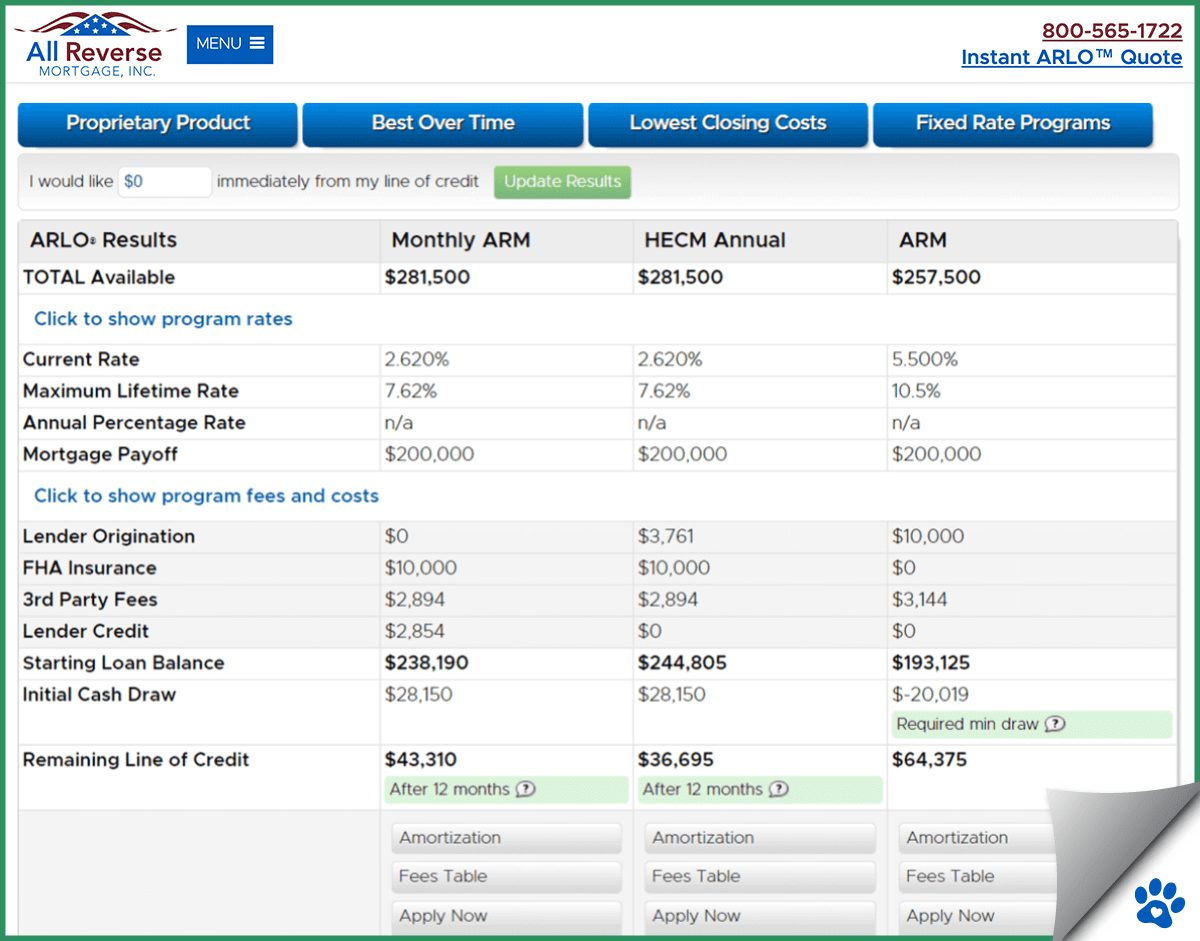

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

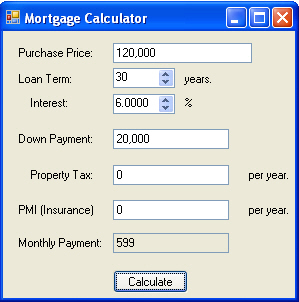

See how your monthly payment changes by making updates.

. Down payment of at least 3 with potential to save on private mortgage insurance. Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels. We offer Fannie Maes HomeReady Mortgage program which is tailored to help low- to mid-income first-time or repeat buyers with limited down payment funds.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. Includes PMI hazard insurance property taxes and more. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan.

Make sure to enter your most current outstanding mortgage balance in our home sale net proceeds calculator to help determine what net cash youll receive after selling. No personal information is required to calculate your estimate. Our mortgage calculator can help you determine what mortgage you can afford by taking simple information about your finances and prospective home to predict your monthly payments including your principal and interest rate.

Real estate agent commissionthe fee charged by both your real estate agent and the buyers agent typically amounts to 5-6 of the home sale price. Start by inputting your property type estimated home value ZIP code outstanding mortgage balance if applicable and the youngest co-borrowers age if applicable. The calculators results page will return a loan option best fit for your needs including the length projected rates.

The Loan term is the period of time during which a loan must be repaid. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. It must be your primary residence that means that you as the borrower must live in the home for as long as you have the loan.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more. Mortgage rates valid as of 31 Aug 2022 0919 am.

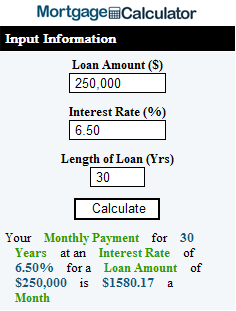

The Mortgage Calculator is crucial in determining the mortgage amount based on an affordable monthly mortgage payment. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan. Section 179 deduction dollar limits.

In the US property taxes predate even income taxes. Use this mortgage calculator to estimate how much house you can afford. You can input your zip code or town name using our.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. NACAs Housing Counselors work with members to prepare them for homeownership including determining an affordable mortgage payment consisting of the principal interest taxes insurance and HOA. We also add in the cost of property taxes mortgage insurance and homeowners fees using loan limits and figures based on your location.

Pay off your mortgage early by adding extra to your monthly payments. HomeReady Mortgage program details. What Are Property Taxes.

Homeowners insurance rates vary depending on where you live and the age and condition of the home. Estimate your payment with our easy-to-use loan calculator. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

The 30-year fixed-rate mortgage calculator estimates your monthly payment as well as the loans total cost over the term. For example a 30-year fixed-rate loan has a term of 30 years. Use NerdWallets free mortgage pre-qualification calculator to see whether you qualify for a home loan and if so what amount you can get pre-qualified for.

This type of loan allows borrowers to access a portion of their equity tax-free without having to make monthly mortgage payments. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. When using a mortgage loan calculator youll need to enter your zip code to receive an accurate estimate.

Enter your ZIP code to get started on a personalized. The Loan term is the period of time during which a loan must be repaid. For instance you may pay a higher premium for a home thats older or hasnt been properly maintained.

Debt-to-income ratio of up to 50 depending on the. See your total mortgage payment including taxes insurance and PMI. Homeowners insurance costs vary by ZIP code and.

In fact the earliest known record of property taxes dates back to the 6th century BC. A reverse mortgage is a loan secured by your home. While the maximum affordable mortgage.

Todays national mortgage rate trends. For example a 30-year fixed-rate loan has a term of 30 years. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

NerdWallets early mortgage payoff calculator figures out how much more to pay. The average cost of private mortgage insurance or PMI for a conventional home loan ranges from 058 to 186 of the original loan amount per year according to Genworth Mortgage Insurance. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for.

Use this free California Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Use our free home mortgage calculator to estimate the cost of your new homes monthly mortgage payment. With a home price of 400000 an 80000 down payment and a 4 interest.

With several primary inputs as well as additional advanced fields that account for PMI homeowners insurance zip codeproperty taxes and homeowner association fees Guaranteed Rates home mortgage calculator incorporates almost every conceivable variable that could affect your mortgage costsThe result is an estimate of future monthly. Get the latest financial news headlines and analysis from CBS MoneyWatch. Property taxes are one of the oldest forms of taxation.

Youll also need to. Our reverse mortgage calculator can help you determine how much money you might qualify to receive in a lump-sum payment. Enter your ZIP code to get started.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

5 Best Mortgage Calculators How Much House Can You Afford

Reverse Mortgage Calculator

Reverse Mortgage Calculator

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator Script Free Mortgage Calculator Widget

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Property Tax How To Calculate Local Considerations

Reverse Mortgage Calculator

Mortgage Calculator Money

5 Best Mortgage Calculators How Much House Can You Afford

How To Use A Mortgage Calculator

5 Best Mortgage Calculators How Much House Can You Afford

Mortgage Calculator In C And Net

5 Best Mortgage Calculators How Much House Can You Afford

5 Best Mortgage Calculators How Much House Can You Afford

Va Mortgage Calculator Calculate Va Loan Payments

Downloadable Free Mortgage Calculator Tool